- Der Artikel ist für registrierte Benutzer kostenlos.

-

Mit einem Benutzernamen können Sie diesen Artikel kostenlos lesen.

Registrieren Sie einen kostenlosen Benutzernamen oder melden Sie sich mit einem vorhandenen an.

-

Lesen Sie viele Artikel kostenfrei. Newsletter bestellen, registrieren und weiterlesen.

Keine Verpflichtung - kein Abo.Sie sind bereits registriert? Anmelden

Hilfe bei der Anmeldung und Registrierung: leserservice@deutsche-wirtschafts-nachrichten.de

Es gelten unsere AGB und Datenschutzbestimmungen

City of London: Capital of an invisible empire

Die Verunsicherung an den globalen Finanzmärkten spiegelt sich am Montag deutlich in den Kursen deutscher Bundesanleihen wider, die...

Nach der Zitterpartie bei der Landtagswahl in Baden-Württemberg verhärten sich die Fronten zwischen den potenziellen Koalitionspartnern....

Ein Bericht der Washington Post sorgt für Aufsehen. Demnach liefert Russland Iran geheimdienstliche Informationen über US-Streitkräfte...

Die deutsche Industrie ist mit einer deutlichen Enttäuschung in das Jahr 2026 gestartet. Laut Daten des Statistischen Bundesamtes sanken...

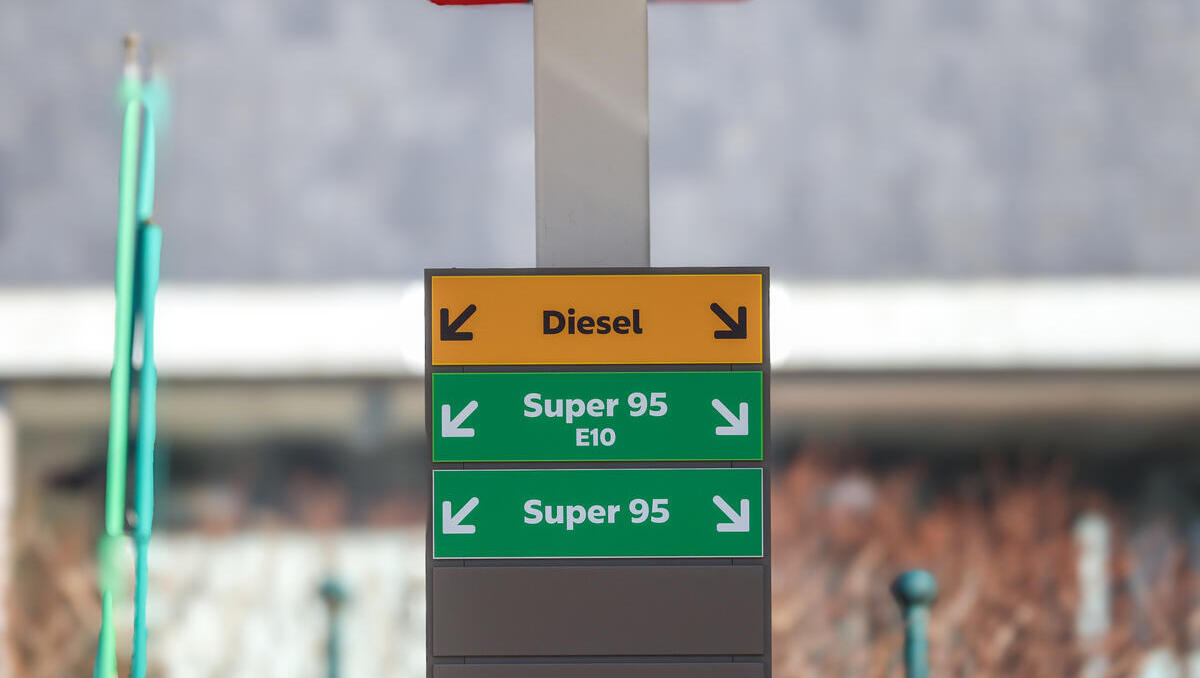

Autofahrer können vorerst leicht aufatmen, da der steile Aufwärtstrend bei den Kraftstoffpreisen an deutschen Tankstellen an Schwung...

Nach einer Phase sinkender Preise müssen Kunden in Deutschland für Butter wieder tiefer in die Tasche greifen. Führende Discounter und...

Die alte Weltordnung ist Geschichte: EU-Kommissionspräsidentin Ursula von der Leyen drängt angesichts der globalen Instabilität auf eine...

Europas Lebensadern auf dem Prüfstand: Nach langer Wartezeit hat die EU-Kommission ihre neue maritime Strategie enthüllt. In zwei...