Introduction

This article contains a counter-consensus analysis of Greece’s economic crisis. This crisis appears to be following the script of an ancient Greek tragedy. The tragedy is leading deeper and deeper into a conflict which is irresolvable for the persons involved and which will end in a collapse or catastrophe. There is no way to avoid blame without denying their inner values and losing their public standing. The climax of the crisis was reached with the collapse of talks between institutions and the Greek government and the mother of all banking crisis after June 27th. This article was originally written in April and May 2015 and published in German in early June 2015. The article is left unchanged except for addendums to cover the events of June 27th / 28th and complete the analysis.

This article is the non-technical summary of a larger text. The main statements of the article are substantiated in detail in this background text. Several informative graphs and tables are attached in an annex out of which only a few will be shown illustratively for reasons of space. The article’s essential arguments are briefly summarised as follows:

Brief Summary

The Troika’s policy towards Greece is based on a fatal statistical error

Ostensibly, the crisis in Greece is about sovereign debt. It apparently resulted from an overly expansionary fiscal policy and a loss of price competitiveness since the launch of the euro. This competitive weakness is supposedly attributable to an excessive rise in labour costs with respect to anaemic macroeconomic productivity growth. Greece is allegedly uncompetitive internationally because the economy’s internal structures do not allow for or support any internationally competitive industries. Bureaucracy, poor regulation, especially in the labour market, excessively high wages and costs are said to be structurally obstacles. Apparently, these are the causes of the periodic disruptions which, in ever shorter intervals, have pushed the country to the edge of bankruptcy since 2010. Hence, also, the strict austerity and deflation program which the Troika has imposed on the country since 2010.

The core problem is actually completely different: Greece is a country with a very large and highly competitive export industry. Its merchant fleet has been the world’s largest since the 1970s. Greek merchant shipping made huge efficienciy gains since the turn of the century. Its tourism sector enjoys a very strong position in Europe. In the 2000s, it successfully evolved from mass to quality tourism, with very competitive prices in the upper and particularly in the top price segments. The country experienced an export boom from 1999 to 2008. No other western European country except for Norway achieved even remotely comparable export growth. Due to conceptual errors in the calculation of the balance of payments and gross domestic product, this export boom was recorded as a growing current account deficit and sluggish GDP growth. Actually, up till 2008, Greece achieved high and steeply increasing current account surpluses, more than Germany did. This export boom was mainly driven by merchant shipping, the country’s dominant economic sector since the 1960s.

Greek economic statistics are seriously distorted, for conceptual and political reasons. This is shown in the background text for the two main export industries, merchant shipping and tourism.

Balance of payment statistics for both industries are collected by the Bank of Greece. Merchant shipping specifically has been conceptually misrepresented in Greece’s balance of payments since it returned to Greece in the 1960s and therefore for more than 50 years. Greece differs in this respect from all other important countries with a merchant fleet. This has to do with its currency exposure and the regulation and taxation of the sector in Greece as well as with the country’s monetary policy regime up till 1994. Since the 1980s, this problem has been known worldwide as the “missing fleet” phenomenon, which even considerably distorts current account balances worldwide and not only Greece’s. Unlike in the rest of the world, up to 1998 in Greece, shipping companies’ freight earnings from abroad were not reported as merchant shipping exports. These exports comprised only transfers to Greece from shipowners’ dollar accounts held abroad. These so-called remittances only covered only domestic factor costs – seamen’s wages, salary payments including the state NAT pension fund in Greece, domestic inputs and company earnings and dividends paid in Greece. All merchant shipping earnings are denominated in USD (formerly also in GBP), because this is how freight rates are posted worldwide. They were held exclusively in the shipowners’ dollar accounts abroad, because Greece had a capital controls regime from 1932 to 1994 inclusive which did not permit any international capital transactions. Shipowners effected the really large payments for their merchant fleets such as the purchase of ships, amortization and interest payments on shipping loans, purchase of fuel, operating expenses such as port and canal fees and labour costs for non-Greeks exclusively from their dollar accounts held abroad. The statistical coverage of merchant shipping in Greece by the central bank improved superficially when it entered the euro. The payments received by Greek banks are fully recorded by a reporting system known as the International Transaction Reporting System (ITRS) introduced newly in 1999, which was previously not the case. Also, a part of overseas freight earnings started being effectively recorded in accounts in Greece. This was a condition made by Greece-domiciled banks for the substantial loans granted to shipowners, especially from 2005/06. The percentage of merchant shipping export earnings included in the Greek balance of payments thereby rose from about 10% in 1999 to about 25% in 2008. However, most of the sector’s exports, about three-quarters to four-fifths depending on the calculation method, are still not recorded statistically in the balance of payments and the national accounts. Due to a constellation of power in domestic politics, the Greek central bank acts reluctantly and defensively. The dominant freight earnings in the dollar accounts abroad are still unrecorded as before. These were mainly the ships of Greek shipowners flying flags of convenience. Conceptually, according to the 1977, 1993 and 2008 (BPM 4/5/6) IMF balance of payments manuals, they are obviously to be assigned to the operating centre’s freight earnings and this is Piraeus or Athens. Similar collection problems also apply to a lesser extent in tourism. The collection procedure there was converted to a new system – the Frontier Travel System (FTS) – with the introduction of the euro. Due to serious errors in tourism sector statistics, this is unable to capture qualitative changes such as the spectacular expansion of five-star hotels in the 2000s. As a result, average hotel prices and per diem tourist spending is distortedly recorded. Consequently, tourism sector exports are also viewed in absolute terms and inaccurately reflected in the temporal dynamic.

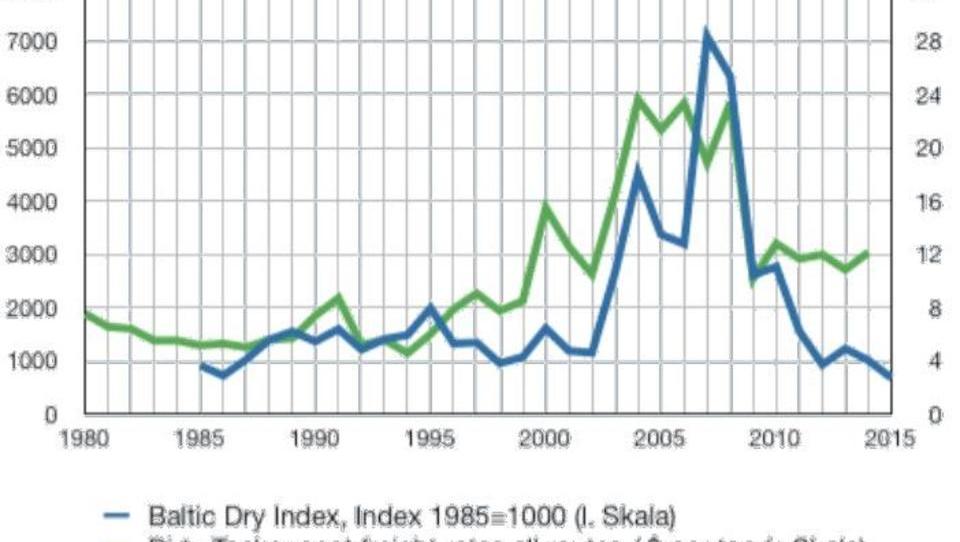

Greece’s export industry is very competitive and is oriented towards the world economy’s above-average growth sectors and is therefore well positioned. However, it is insufficiently diversified and is particularly concentrated on an extremely cyclical major sector – merchant shipping. Furthermore, in comparison to the rest of the world, the Greek fleet is concentrated on the segments of merchant shipping which are the most cyclical by far, namely, tankers and dry bulk carriers - transport ships for raw materials such as iron ore, coal, grain etc. Since 2008, both these segments have been exposed to an extreme sectoral price decline which is hitting all operators hard. The same sequence as that of the 1970s and early 80s is being repeated: Strong synchronised growth in the world economy, full capacity utilisation, a steep rise in freight rates, large orders for very big ships (early 1970s, second half of the 2000s), then the first oil shock (1973; 2007/08), then the second oil shock (1979/80; 2011-14), sharp fall in demand for sea freight and high overcapacity combined with a collapse in freight rates. In 2014/15, the average freight rates for tankers were about 30 – 40% below the average for the 2000s. For dry bulk carriers freight rates have even declined by 70 -80%. In contrast to the 2008 peak level, the falls were even as high as 50% and 95% respectively. In the hotel and restaurant sector, prices also fell by about 20% compared to 2007/08. The collapse of Greece’s exports is a cyclical sectorally-determined slump. No other country suffered such a collapse of exports as a result of concentration risks. Nevertheless, during the expansion phase and also during the recession since 2008, Greece clearly strengthened its competitive position in these two export industries in comparison to the rest of the world. However, Greece has been much weakened as an economy.

An extremely deflationary foreign trade price shock...

What first brought Greece to its knees was an extremely deflationary foreign trade price shock. The two oil shocks of 2007/08 and 2011- 14 represent enormous burdens not only for its merchant fleet, but for the Greek economy as a whole. In the 1990s, Greece spent about 1% of its nominal GDP on its visible oil bill (net energy imports minus energy exports) annually. In the years 2006 – 14, this percentage increased to an average of over 4% of the nominal EDP – GDP. This percentage even exceeded 5% during the peak years. In addition, there are fuel costs for the merchant fleet which is refuelled around worldwide and hardly ever in Greece. That expenditure is not included in the Greek trade balance. It should be recorded under imports (intermediate inputs) of shipping services. If all the freight earnings of Greek shipping companies was correctly recorded and not only about one – quarter, the energy bill would actually increase to about 15 – 20% of the correctly calculated nominal GDP.

No other developed economy is as massively dependent on oil prices as Greece is. This dependency reflects the country’s maritime exposure. Greece has thousands of islands, many of which are tourist destinations that are very remote from the mainland and must be reached by sea or by air, which entails high transport costs. On the islands, electricity and heating are provided only by oil/gas combustion in thermal power plants. Greece also has the world’s largest merchant fleet. The fleet’s fuel expenditure represents the greater part of the costs of voyages and – during oil shocks such as since 2001 – even the total cost. What hit Greece massively, unlike any other economy, is a double price shock in its foreign trade. A collapse in its key export prices since 2008 and, parallel to that, a price explosion in import or input prices. Hence the extreme deflationary pressure from the foreign trade sector. The Greek central bank’s official current account figures therefore present a false picture because they only record a fraction of freight earnings and energy expenditure: exports could have been underestimated by about 60 billion euro for 2008. Correctly calculated, the current account was in surplus from 1999 to 2007/08 and there has been a big deficit since then. The official current account balance shows exactly the opposite of the actual development, with disastrous consequences for the interpretation of the economic problems and the formulation of a policy response.

In essence, at issue is a cyclical international trade price shock, identical to that of the early 1980s. It first started in 2008, after the terms of trade in international trade had previously been extremely favourable to Greece’s current account. It’s the exact same constellation as in the early 80s: a fall in freight rates combined with the second oil shock of 1979/80, which then lasted till 1985. It’s a classical terms of trade shock which is unrelated to the internal price and costs dynamics in Greece. Greece is a pure price-taker for these goods and services. In the 1980s, Greece’s policy responded correctly in principle, namely, with an expansionary fiscal policy. In the 1980s, this prevented a slide into a severe recession or depression. Two things were wrong at that time:

- Labour market policy and wage determination in the core sector, merchant shipping. Steeply rising salaries for Greek seamen as a result of the wrong choice of reference currency for the payment of wages after 1977, led to a dramatic loss of seafaring jobs in Greece in the first half of the 1980s. This had grave consequences for shipowners’ remittances and the current account at the time and favoured a fall in the Greek drachma.

- The fiscal expansion was not implemented as a temporary economic policy measure. It was continued unchanged under different economic conditions and paved the way for clientelist party politics with the well-known consequences for budget deficits and government debt.

The state of official data and the prevailing analysis of the growing current account deficits since the introduction of the euro are incorrect. Correctly calculated, Greece never showed deficits between 1999 and 2008, but rather increasing surpluses. Just as wrong is the claim of insufficient productivity gains and even more so, that of excessive labour costs increases. Solely as a result of the recording of a fraction of merchant shipping earnings, the GDP for the years 2007 and 2008 was underestimated by about 15 to 20%. On the contrary, from 2003 to 2008, wages increased insufficiently with respect to the productivity gains actually achieved. When correctly measured, real wages were already in decline during the upswing, although the economy was experiencing the biggest boom in Western Europe. Furthermore, budget deficits and the level of government debt relative to actual GDP were nothing like the order of magnitude in the EDP procedure. The only thing that is correct is that the balance of payments data published by the Greek central bank and the national account data derived therefrom support the interpretation of rising wage costs and an overly expansionary fiscal policy superficially, from a highly aggregated perspective.

…is aggravated by a misguided policy of internal deflation …

Hence, the Troika formulated a wrong response, i.e. an unprecedented internal deflation as a response to an external deflation of a rare extent in a small open economy. The concept of internal devaluation, as it is called, is inappropriate for several reasons:

- Greece’s export economy does not benefit at all from very low wages and prices. This has to do with its structure. Earnings and expenditure by merchant shipping, the largest export industry by far, are almost exclusively dollar-denominated and have little or nothing to do with Greek labour costs. In contrast to the situation at the beginning of the 1980s, shipping companies now employ fewer Greek seamen. Most seamen are Filipinos and Indians, who are paid in their home currencies. In addition, the merchant fleet is extremely capital intensive, and this is in contrast to its structure some decades ago. Many of the exporters in the tourism sector are family businesses with low numbers of non-family employees. By contrast, the bigger firms operating five-star and four-star hotels are capital intensive. So, on the contrary, wages did not constitute a hindrance to the unprecedented expansion in five-star hotels since 2003. In any case, in both industries, cheap, unreported work of illegal immigrants is a significant form of employment.

- The internal devaluation policy does not take into consideration the previous strong credit expansion and debt levels of private households and companies. Nominal incomes were reduced through seriously reduced wages, pensions and prices as well as through high unemployment. As the outstanding debt to the banking sector and to the state remains unchanged, the current burden of interests, amortisation and taxes and the value of the outstanding debt continue to rise in real terms. A debt deflation situation has been thus created.

- This debt deflation was greatly aggravated by the systemic banking crisis which acts as a financial accelerator for the economic crisis. A withdrawal of foreign interbank deposits started with the supposed 2010 sovereign debt crisis, which led to a lending freeze in the banking system. The Troika unwittingly intensified this process. Monetary policy was ultra-restrictive because the banking system’s equity capital was temporarily destroyed by the debt cut imposed by the Troika in 2011. It has never been adequate built up again since then. Due to this credit event, the banks were obliged to immediately make extremely high write-offs. This destroyed a large part of their capital. However, recapitalization did take place, but belatedly, in 2012 and 2013. The banks had to suspend or strongly curb lending because of the temporary massive reduction in their capital. The lending freeze led to the collapse of construction investment to almost zero. The liquidity crisis stemming from the banking crisis spread to large sections of the real economy and pushed tens of thousands of companies and households into bankruptcy and cost hundreds of thousands of employees their income. The banks’ non-performing and bad loans rose steeply as a consequence of the general liquidity crisis. These bad loans have to be backed by much higher equity with the result that even after the belated recapitalisation, the banks themselves were unable to come out of the situation of inadequate equity or risk capital. The massively deflationary policy exercised through the banking system together with the foreign trade price shock (fall in export prices combined with skyrocketing oil prices) lies at the heart of the Greek crisis. The temporary destruction of banks’ equity capital triggered a systemic banking crisis which is reflected in an almost unprecedent credit crunch and a liquidity crisis extending over the whole economy.

- The role of fiscal policy alone in the crisis is overestimated or incorrectly assessed. A consolidation was necessary, granted. But the Troika set the priorities badly. The fiscal consolidation was not only too abrupt; it had extremely negative distorting effects from an economic policy standpoint. Those who had been paying taxes up to then – workers in regular employment and households – now pay much more and receive lower benefits. The combination of tax measures – especially the sharply increased rates of VAT, income tax and profit tax – and spending cuts has greatly increased the incentives for tax evasion in the commercial sector. Consequently, those who had been paying little or no tax up till then still pay none or too little. Certainly, many of the self-employed and many companies can no longer pay because of the economic situation. In contrast, it would have been relatively easy to get hold of considerable amounts of evaded taxes parked in offshore accounts abroad, without such economic damage.

… which leads to a debt-deflation spiral

This is why this article characterizes the crisis as a debt-deflation spiral. Because the policy of internal devaluation adds an internal debt deflation to the external debt deflation in the economy’s most important sector, merchant shipping, and triggers a comprehensive and cumulatively intensifying process of macroeconomic debt deflation. The four characteristic elements are the destruction of banking system equity or risk capital, falling real estate and ship prices, which are the most important collateral for bank loans, steeply rising bad loans and periodic withdrawal panics among banking system depositors. The banks can no longer make loans and plunge the economy into a comprehensive liquidity crisis. The banking crisis acts as a financial accelerator of a cumulatively intensifying economic collapse. Debt deflation consists of sharply falling nominal incomes and prices together with unchanged nominal debt owed to the banks and rapidly rising nominal debt to the government. Interest rates and the tax burden rise drastically in real terms due to the fall in nominal income making debts and borrowing costs unsustainable. The manifest sovereign debt crisis reflects only one underlying process of a full-fledged debt deflation.

Given this analysis, the major policy options will be discussed at the end of this article and both an exit from the euro and a continuation of internal devaluation have been rejected. An exit from the euro would damage shipping and tourism irreversibly. A devaluation would not benefit sea transport, because its costs and revenues are dollar – denominated. Moreover, these two major export industries are very capital intensive. The four- and five-star hotel segments of the tourism sector offer potential which requires high capital expenditure, just like sea transport. The potential of both sectors of the economy can only be fulfilled by remaining in the euro with a banking system that can provide an elastic credit supply at low interest rates. A return to the drachma would mean high and volatile interest rates with fluctuating risk premiums.

The focus of attention is not on “reform” measures of the existing type, but neither on selective social or fiscal policy measures. The Troika’s “reforms” only deepened the domestic economy’s debt deflation. Given the unprecedented banking crisis, the banking system must be immediately recapitalized and the credit mechanism restored. This is the only way to alleviate the country’s catastrophically acute liquidity crisis. A further financing of the public budget alone will not suffice and, if accompanied by further falls in wages and pensions or VAT increases, will only aggravate debt deflation. The most important points concern a rapid and substantial recapitalization of the banks, a transfer of non-performing and bad loans to a properly designed “bad bank”, the abolition of withholding tax on interest income on domestic bank deposits and a profound modification of merchant shipping regulation. Shipowners must disclose all their accounts, including offshore accounts to both tax authorities and the central bank. They must report global turnover and inputs annually and on a reduced scale on a quarterly base. Shipowners should be allowed to retain their tax privileges for shipping activities within the existing framework. But besides transparency only if they hold their liquidity in Greece instead of in offshore accounts abroad. This is the only way the banking system deposit base can be rebuilt. These measures will cost something initially, but can be revisited during a subsequent privatisation.

Initial Situation: The Missing Fleet

The standard analysis has it that Greece, like the other periphery countries, lost some of its competitiveness when it adopted the euro. Price competitiveness suffered due to excessively high wage rises in relation to weak productivity gains. This was supposedly made possible by an expansionary spending policy. In a currency union, this wage-dependent competitive disadvantage can only be corrected through drastic nominal and real wage reductions. Drastic structural budget cuts must be made in order to achieve a primary surplus. Hence the policy of wage cuts and reductions in nominal wages in both the public and private sectors which were carried out relentlessly. Hence the endless hikes in direct and especially indirect taxes and levies. Hence the spending cuts in investments, current spending and pensions. In this view, an economic collapse is an unavoidable adjustment effect of this austerity and deflationary policy. The weak export performance can only be improved by microeconomic structural reforms to the labour market, the deregulation of the whole economy and comprehensive reform of the state. By contrast, competitive disadvantages can be compensated for in the event of an exit from the euro by the associated devaluation. Proponents of this interpretation such as Hans-Werner Sinn recommend that leaving the currency union would serve the country best.

What can excuse this interpretation and this action approach are Greece’s official economic statistics. With respect to the calculation of the balance of payments, external position and gross domestic product, especially exports, but also imports and investment in building construction, they are incorrect. They have actually been depicting a desolate picture of the Greek economy with respect to export growth for a long time, and especially since the launch of the euro. The Greek central bank is primarily responsible for this. It has been organising the balance of payment statistics for decades. The government statistics office only takes over these results and fits them into the national accounts. Hence, the fact that the reactions in economic policy in Europe and Germany to the euro crisis which started from Greece were of this nature is explainable and can be accepted. However, the Troika’s experts and policy advisers called in by the German and European decision-makers were also incompetent, and not only the Bank of Greece. In the event of a crisis, the one of the first things to do is always to examine the quantitative figures and to trace every possible weak point. And a critical examination would have thrown out the whole representation. Nevertheless, let us state the facts:

Greece’s exports have been structurally underestimated in the service balance for decades, because only a small part of merchant shipping or the shipping companies was included, and indeed a part decreasing over a period of time up to 1998. This sector has been dollar-denominated since the 1950s and especially on the revenues side and – increasingly – on the expenditure side. This is why Greek shipowners traditionally hold accounts with banks in New York, London and Geneva and have historically almost never made payments through Greek or Greece-domiciled banks until the introduction of the euro. The fact that shortly after the establishment of the Bank of Greece (in 1929), Greece went over to a regime with rigid capital controls in 1932 and maintained this regime more or less unaltered until 1994 also played a role in this respect. It was almost impossible to carry out international capital transactions through Greek banks. In view of this monetary policy regime, the central bank dispensed with recording the freight revenues of shipowners operating in Greece and to designate them as exports. This was in contrast to the practice of almost all other countries with an influential merchant fleet. The only things that were recorded on the income side of the shipping sector’s balance sheet up to and including 1998 were the shipping companies’ internal factor costs – wages and social security contributions, especially payments into the seamen’s NAT pension funds, domestic intermediate inputs and dividends and company revenues paid out in Greece. They were financed by means of shipowners’ transfers (remittances) from their dollar accounts held abroad. The freight revenues of Greek shipping companies were historically almost never recorded in either Greece’s nor in foreign countries balance of payments up till 1998. That is the problem of the “missing fleet” which has occupied the international balance of payments statistics since the early 1980s. The greater part of freight revenues and liquidity remained in dollar accounts abroad. This liquidity came into domestic circulation in Greece though through various channels, but in highly cyclical manner. Structurally, up to and including 2002, the reinvested proceeds do not remain in the foreign accounts at all, and have been insufficiently recorded since 2003. Because the shipping companies possess large and increasing capital abroad, their revenues were completely mixed therewith. By the time it adopted the euro, Greece’s current account, if correctly calculated, was in surplus and not in deficit, as represented in the official figures. By the end of the 1990s, with respect to export proceeds, the shipping companies were actually several times more important than tourism and even more so than the export of goods.

The unrecorded export proceeds of Greek shipping companies have been an issue in international economic statistics for decades. Thus, after several attempts, American authorities and the IMF discovered that the evidently incorrect figures of the American and global current accounts balances were largely attributable to the inadequate recording of the freight revenues of Greek shipowners. Between 1984 and 1987, the IMF carried out a comprehensive investigation into the reasons for the negative global current account balances through a working group (Esteva Report). In principle, the surpluses and deficits of the current accounts of all countries should balance out. However, from the 1970s, a rapidly increasing tendency towards aggregated deficits of about 100 billion USD was established between 1981 and 1985. One of the three fundamental reasons identified, actually the most significant, was the non-reporting of income from the shipping industry by a few countries with very large fleets, Greece and Hong Kong being at the forefront (“The Missing Fleet”).2 In subsequent years, the considerable discrepancy between reported credits and debits in sea freight transport was also an issue for working groups from time to time.3 In the 2000s the discrepancies in the sea transport balance virtually exploded, without any further clarifications. In the past, concealed trends of “invisibles” in the balance of payments were responsible for many macroeconomic enigmas and policy errors. The fact that the shipping companies’ surpluses must have caused very serious distortions not only for the U.S. balance of payments, but also for the current account balances of the much smaller Greece was never identified as a central issue in the IMF documents. This reflects a form of organisational blindness.

Greece’s fleet of tankers and bulk carriers has been the world’s largest since the 1970s. The tankers carry crude oil and products such as petrol, diesel and kerosene, chemicals or also gas. The so-called dry bulk carriers transport bulk cargo goods such as iron ore, coal, grain, bauxite or phosphate. This is a growth sector of the world economy, with growth rates clearly above

The International Monetary Fund: Final Report of the Working Party on the Statistical Discrepancies in World Current Account Balances, Washington D.C. (1987) came to the following sobering conclusion with respect to Greece’s shipowners: “Moreover, the Greek balance of payments excludes the operations of the Greek fleet because the owners of that fleet do not reside in Greece and, as far as the IMF is aware, they are not residents in other countries either”. (IMF, 1987, p. 90).

IMF: Global Discrepancies in the Transportation Account. Fifteenth Meeting of the IMF Committee on Balance of Payments Statistics, Canberra, Australia, October 21 – 25, 2002. those of the world’s aggregate output or even more so, than the gross national product of the OECD countries. In the 2000s, merchant shipping and particularly the two largest segments occupied by Greek shipowners profited from a boom similar to that of the 1970s due to emerging economies’ hunger for raw materials. Freight rates, i.e. the prices for transport services, in both these areas precisely – for tankers and bulk cargo carriers – rose several-fold within a few years just like crude oil prices. Freight rates for bulk cargo increased seven-fold between 1999 and 2007/08 in dollars, if measured in annual averages. In euro terms, they quintupled. Freight rates for tankers increased six-fold between 1995 and 2008 in both dollar and euro terms.

Added to this are large economies of scale due to the fleet’s build-up, maximum capacity utilisation and efficiency gains in the boom years. Measured in ton-miles, transport capacity supposedly grew by more than 50% from the end of the 1990s to 2008 and doubled by 2014. All this is not reflected in the Greek current account. Since 1999, only transfers paid to the shipowners Greek branch through Greek or Greece-domiciled banks have been recorded therein as shipping company exports. This is a only a part which mainly covers the ships which were purchased new in the 2000s and paid through transaction in Greece-domiciled banks. The banks usually require that payments for a foreign-financed ship be made through accounts held directly with them to guarantee loans. Additionally, there are revenues from management agreements of the management company with the offshore companies owning the vessels. Furthermore, the Bank of Greece uses publicely available information from listed shipping companies. However, the majority of revenues for foreign financed ships and from ships mostly under foreign flags that are paide off are not captured. Using six different statistical procedures and approximations, the annex shows that only about 15 % of the exports of the Greek merchant fleet were recorded in 1999 and only about a fifth in 2008.

As an illustration of how absurd the figures in the Greek current account are, the load capacity of the large European merchant fleets will be compared with the nominal production values for the shipping industry according to the National Account System (NAS). The latter are, as far as Greece or even Denmark are concerned, identical to the current account export values except for minor differences. Both countries have a cross-trader fleet. They transport goods mainly or exclusively between third countries. In Greece’s case, the production values are derived directly from the balance of payments values. In contrast, the fleets of bigger countries such as Germany or the U.K. also supply the domestic economy. This is why part of the output is recorded as services for the domestic economy and not as an export. Hence the comparison of carrying capacity measured in dead weight tonnage with production values and not just export values. The carrying capacity is taken from the statistics of the international trade organisation UNCTAD in its annually published “Review of Maritime Transport”. This is the standard publication for worldwide merchant shipping. During the 2000s, fleets were almost continuously fully occupied, in contrast to the 1980s and 1990s. Production values are defined according to identical criteria on the basis of the ESA 95 standards of the national accounts system.

The first diagram shows that the fleet controlled from Greece displays quite a different dimension from all other fleets. It’s only since 2008 that the German fleet has had an order of magnitude equivalent to about half of the Greek fleet. In the late 2000s, Germany experienced an strong growth in capacity in the container fleet. At that time, the dimensions of the fleets of all other countries were smaller than the one controlled from Greece. The picture would be different if the production values were used in accordance with the NAS. According to the second graph, in the 2000s, Greece supposedly produced not only much less output than Germany and Denmark. It was also mediocre in comparison to countries with much smaller fleets like the UK or Norway. The carrying capacity of the United Kingdom’s fleet never amounted to more than 10% of that of Greece. Even countries with an almost insignificant fleet like France or Italy have almost the same order of magnitude with regard to the gross production value as the world’s largest fleet by far.

Some observations should be made here.

- The collection procedure for other countries’ fleets is fundamentally different from that of Greece. In the other countries, the shipowners’ industry associations carry out in-depth surveys of their members at least yearly, sometimes quarterly and publish them shortly after. This occurs in Germany, the United Kingdom, Denmark, Norway and France. In these countries, shipowners are required to disclose their turnover and other figures to government authorities. By contrast, in Greece, neither the central bank nor any other authorities have access to the company data. Due to the Greek form of tonnage tax, shipping companies are not required to file tax returns. The Greek central bank relies on the ITRS and makes adjustments. The error in Greece’s conceptual approach is that the national ITRS is not linked internationally. As the shipowners’ foreign accounts are omitted, this causes these enormous distortions. The Greek approach would resemble a multinational company, that calculates their global turnover or sales from inflows in the headquarter treasury.

- During the period from 2000 to 2011, depending on the year Greece had 40 – 50% of the carrying capacity of the whole of Europe’s fleet, not only of the countries listed in the graph. Therefore, turnover should – with a large standard deviation – be about as large as the sum of all the turnover of the countries listed in the illustration together. Actually, it should even be far larger up to 2008, because Greece was specialised in the areas in which freight rates skyrocketed. That would be about 100 billion euro for 2008. If the shipowners who are indeed recorded as Greek but who were operating abroad are also counted, then a turnover of about 80 billion euro would be obtained. There is a discrepancy of roughly 60 bn euro with the recorded size of 20 billion euro or a quarter of nominal GDP. Note that this is a rough estimate. However it is confirmed by comparison with five other indicators in the approximate order of magnitude in the annex. Conversely, the 2011 collapse must have been much larger, because freight rates had already fallen sharply by this time.

In Greece, shipping companies have been exempt from taxes on profits, capital levy and capital gains since a 1957 tax reform and this exemption has even been constitutionally mandated since 1975. In addition, shipowners as private individuals are exempt from income, property and capital gains taxes as far as these relate to earnings or capital from shipping. Companies only pay a so-called tonnage tax, i.e. a tax on a ship’s gross register tonnes corresponding to its age. However, an additional 15% withholding tax on the interest yields of bank deposits also applies to both companies and private individuals. This cannot be offset against anything and is not reimbursed. This is one reason why shipowners still want to keep all available liquidity in offshore accounts abroad nowadays. During the price explosion phase from 1999 to 2008, shipping companies were virtually swamped with liquidity. Hence the lack of interest in a declaration against authorities. Incidentally, something similar applies to other export and domestic economy sectors. This is the reason for the poor export performance of the hotel industry despite the 5 – star hotel boom and the reason for the poor export performance of other sectors. The withholding tax on bank deposits was introduced in 1991 and increased to 15% in 1992. It applies to all bank deposits of Greece-domiciled companies and resident private individuals, and therefore also to those abroad. This is a poorly designed tax, because it encourages tax evasion. In the hotel industry and other sectors of the economy, the normal corporation tax and capital levy on companies are in addition to the withholding tax.

After a boom up till 2008, shipping suffered a collapse like in the early 1980s. This also reflects the same sequence and causality as then: the double 2007/08 and again 2011 to 2014 oil shocks which rapidly followed each other, high orders for ships in the previous boom phase which resulted in fleet expansions in the middle of the slump and then overcapacity and the fall in freight rates. An important factor for the concentrated orders for ships was the increase in oil prices in the 2000s. Fuel costs are a major component of the total costs of ships. When oil prices increased from $20 - $25 per barrel in the 1990s to over $60 in 2005 – 08, many older ships became unprofitable. The newly ordered ships were usually much larger and had far more efficient engines which consumed less diesel or bunker fuel and allowed for a higher transport capacity. This was also a reason for the global investment boom. In addition to the massive capacity expansion, the weakening of the economic dynamic of transition economies, especially China’s, has also played a role in the merchant shipping crisis since 2008. Consequently, with respect to earnings, Greece’s most important export industry has been at the mercy of an unprecedented deflationary pressure since 2009. For example, freight rates for bulk transporters have fallen by over 90% since 2008 while freight rates for tankers have fallen by about 50%. No other country in the world has had an even remotely comparable collapse in export prices and earnings like Greece.

This had already occurred once in the early 1980s. However, then it mainly affected Greece’s fleet, which had fully participated in the supertanker boom of the 1970s. The crisis of recent years has not left Greece’s fleet untouched. However, other fleets were really hard hit. During the boom in bulk cargo carriers and container ships, they increased their investments in new ships massively. Among these are the fleets of Korea, China, Singapore and Germany, out of which China represents a special case. The Greek fleet has remained true to its traditional anti-cyclical behaviour. It has been investing heavily since 2012, now that the prices of new ships have fallen massively. And it is also buying relatively new ships from the secondary market in compulsory auctions and bankruptcies, which come at a fraction of the prices once paid in the newbuilding ordering. In contrast to the early 1980s, the Greek fleet has clearly improved its competitive position in the severe sector recession or even depression.

What applies to merchant shipping also applies to a lesser extent to the tourism sector. The export earnings of the tourism sector are also considerably underestimated in the balance of payments. This is due to a collection methodology which has changed since the adoption of the euro in 2002. It is very difficult to correctly record tourism services within a currency union. For this reason, since 2002, export earnings have been determined on the basis of surveys of tourists. Thus they are asked about their average daily expenses, the prices paid for overnight stays, etc. and the duration of their stay. Inferences are drawn from the statistical population using these surveys. This method – Frontier Travel Survey (FTS) – is also applied in the other periphery countries and many other European countries.

However, due to issues with evaluating surveys, it is unable to depict the tourism dynamic. Comparisons of export figures in the current account with other quantitative indicators of the tourism industry show that it expanded very strongly in the 2000s. None of this can be seen in the export figures. This is due to the inadequate recording of the data concerning overnight stays according to hotel categories. What the Greek tourism sector of the 2000s shows is a strong increase in five-star hotels bed capacity and overnight stays. Not only did this category expand, all other sectors stagnated (four – star hotels) or are clearly in decline (one to three – star hotels). Five – star hotels manage the highest output and added value per employee by far. Due to the steep growth of this sector through the structural shift into luxury hotels, the nominal and real turnover in the tourism sector on the whole grew rapidly even though the aggregate numbers of visitors and overnight stays between 2000 and 2009 on the whole grew insufficiently dynamically. Both main sectors of the Greek economy – merchant shipping and luxury hotels – are very capital- intensive and profited greatly from the low interest rates and improved financing conditions after the adoption of the euro. The luxury hotel sector also passed part of its export earnings through offshore centres abroad and not through its accounts in domestic banks. This is made possible through the tax optimisation of large hotel chains, accounts with large travel promoters and partly with online portals.

The real causes of Greece’s economic and structural crisis

According to official doctrine, Greece is bureaucratic, inefficient and characterised by excessively high costs. Some of this may be true, but all that has nothing to do with the current crisis. Greece’s crisis has nothing to do with poor competitiveness, excessively increased labour costs since the introduction of the euro and suchlike. It is mainly the result of inadequate economic statistics. The first, but not the only party responsible for this is the Greek central bank, which prepares the balance of payments and the international investment position. Since 1998/1999, the Bank of Greece could fall back on a unified form of the International Transaction Reporting System (abbreviated as ITRS).4 This is an end-of-day settlement reporting system and it covers all transactions with foreign countries carried out through Greek banks. The error lies in the politically motivated restraint with respect to shipowners, the real power in the country. Instead of demanding annual balance sheets certified by renowned auditors and to also link up the foreign accounts of shipowners and other economic sectors to the ITRS, the Bank of Greece left it at annual questionnaires with self-declarations.

The ECB, which calculates the current account balance and external position for the whole Eurozone and therefore is also answerable for the quality of this data, is also partly responsible. When Greece achieved enormous current account surpluses year on year and these were invested outside the eurozone through the export of capital, this also altered the Eurozone’s current account balance and external position. Therefore the ECB has an oversight function and has obviously never exercised it since the introduction of the euro. The erroneous statistics do not credit to the IMF which prepares the balance of payments from a global perspective and should compare or coordinate them. Although in its own documents, the IMF has been describing the earnings of the “missing fleet” as the main reason for the globally distortedly measured current account balances for decades, the IMF has not made any efforts to correct the Greek current account balance since the beginning of the Troika mission. The earnings of Greek shipowners are still flowing mainly into offshore foreign accounts in the Marshall Islands, Liberia, the Bermudas, Panama or in other tax havens which do not have any double taxation agreements with Greece. According to the IMF’s balance of payments manuals, these earnings belong to the export earnings of the country from which the shipping fleet is operationally controlled – therefore, in those of Greece. It does not matter under which flags the ships are registered. Incidentally, they do not appear in the balance of payments of these open registry nations, because the shipowners of these countries are not required to provide any information in this respect. It is still the same problem of the “missing fleet” as in the 1980s. In the 2000s, because of this and due to the incorrect recording of the tourism sector, Greece’s annual export earnings, up to a third of the recorded gross domestic product is suppressed. Even today, after the severe plunge in freight rates, the export earnings of shipping companies and the tourism sector are still massively underestimated.

Because only a small part of the freight earnings of shipping companies is recorded, the second dominant component of Greece’s current account is also massively underestimated. The shipowners’ expenditures fuelling abroad are also to be counted as imports. They are supposed to be recorded in the trade balance under imports and intermediate inputs of the shipping fleet. Just like freight rates, oil prices are extremely volatile. They increased about six-fold in US dollar terms between 1999 and 2012 and about fourfold in euro terms. For this reason, the energy bill (imports of energy less exports) completely dominates the growth of imports in the current account. Like freight rates, they have increased very steeply since 2004. However, since 2008, they have evolved quite differently from freight rates – they have risen again massively on an annual basis after a short and sharp decline in 2009. Incidentally, the price of fuel for ships (bunker oil) is highly correlated with the price of Brent crude.

In view of the weighting of merchant shipping, energy imports and the enormous cyclical variation, the growth of Greece’s current account and its balances is completely dominated by freight rates and oil prices. All other factors, and therefore the unit labour costs thus emphasised by the Troika, for instance, are irrelevant. What has been playing out in Greece’s current account since 2009 is a collapse of the most important export prices together with a simultaneous skyrocketing of important import prices. The increased energy bill is nothing other than a massive transfer payment abroad. On one hand, it depresses domestic consumption and on the other hand, it eats up the margins or net product in merchant shipping. This extremely negative price dynamic is the major reason for Greece’s crisis. It is an extreme external demand shock.

The second cause of Greece’s crisis is a shipping regulation system that has become obsolete and dysfunctional. A country which was actually achieved very high current account surpluses for a full decade should not be dependent on foreign short-term capital and consequently be fully exposed to exogenous shocks such as the 2008 financial crisis or the 2010 one. The merchant fleet’s tax privileges are only justified from a macroeconomic standpoint if this results in an inflow into domestic deposits. The banking system in Greece would then have been solidly financed. This second reason is also ultimately imputable to Greece. In this respect there was both the weakness of the Greek central bank, which did not develop any concept and any response to the problem of the financial stability of the banking sector and policy, which was probably driven by supposed interests of shipowners not wanting to alter anything regarding the tonnage tax and shipping regulation status quo. In this connection, the counterproductive effect of the withholding tax on domestic bank deposits must be emphasised. It led to the establishment of a second circulation abroad, mainly in offshore accounts, in addition to the domestic one. Due to this abnormal constellation, from 2004 onwards, domestic long-term loans were massively financed by short-term interbank funds from abroad. This led to fundamental balance sheet structure risks risk (ALM) and rendered the Greek banking system so vulnerable to withdrawal risks. The following diagram illustrates how external interbank obligations increased from 20 billion euro to 80 billion euro from 2004 to 2008. Non-bank deposits from outside the euro zone represent mainly shipowners’ accounts for their foreign-registered ships and hence actually domestic deposits.

The third cause lies in is the passive conduct of the Greek governments of the 2000s in fiscal and economic policy. And in this respect, revenue shortfalls dominate, not outrageous spending. The Simitis and Karamanlis governments did indeed make unnecessary expenditures for the 2004 Olympic Games in Athens or for the politically motivated distension of public sector employment. However, the origin of the Greek budget deficit lies in the revenue side. Even in the official EDP statistics, the percentage of the GDP constituted by government spending in the 2000s up to 2008 did not increase, but dropped. If consideration is given to the unrecorded growth in merchant shipping, luxury hotels and investment in building construction which is not or inadequately captured in the gross domestic product, then the spending proportion even fell quite considerably during the expansion phase.

However, what fell behind even more was the growth of tax revenue. A detailed analysis shows that two tax components underwent an actual structural break:

- Companies’ corporation tax and capital levy stagnated from 2000 to 2008 in absolute terms. Their percentage share of EDP-GDP fell sharply. Yet, they should have skyrocketed as in the second half of the 1990s. Their proportional share of the official EDP-GDP was not below average in comparison to other countries. During a boom as strong as that of the 2000s, such a very high, over-proportional increase in corporation tax would have been normal. This differentiates Greece fundamentally from all other countries, and even also from the other periphery countries. There, corporation tax revenue rose massively, also proportionately to the EDP-GDP.

- There was also a below – average increase in households’ income tax, i.e. less strongly than GDP. On top of that, Greece has the lowest income tax revenue relative to GDP in absolute terms, although the income of self-employed persons (40% of all workers) is included therein. In Greece, income tax represents only about 5% of EDP-GDP, but this is twice the European Union average. In the other countries, even in the other periphery countries, income tax revenues clearly increased stronger than GDP in the 2000s.

While the statistical findings are relatively simple, the economic explanation is more complex. What emerges clearly from this comparison is a pronounced special development on Greece’s part. This started around the turn of the century. It cannot be put down to discretionary alterations of tax rates and also not to the spending side. It represents a structural break with respect to the 1990s. Then tax revenues increased more than spending which led to primary surpluses’ of at least about 4% of EDP-GDP in the second half of the 1990s. In the 2000s, primary surpluses declined up till 2005 and changed into primary deficits in the best boom years of decades. The reasons for this structural break can only be indicated here, but cannot be discussed extensively and in depth:

- One possible hypothesis is disinflation and its effect on tax progression. In the 2000s, the inflation rate fell sharply, from double-digit rates in the 1990s to about 3.3% in the 2000s. The still only moderate increases in nominal incomes led thereby to slower progression to higher income tax brackets. This loss of the significance of bracket creep mainly affects income tax.

- The high inflation rates of the 1970s to 1990s which were always in two digits together with the tax rate bracket creep and the extreme social inequality also constitute an explanation for the widespread tax evasion and the large informal sector in Greece. They explain the low share of income tax in overall tax takings. The amount of the tax burden from VAT, income tax and other taxes and social security contributions is enormously high and favours tax evasion and unreported employment. In particular, only a small part of the income of self-employed persons, who constitute more than 30% of employed persons, is taxed. These high tax rates cause a collusion of interests between producers and consumers. When correctly taxed, a service quickly costs twice as much as a cash payment without evidence. Many households could barely afford dentists, their own homes or lawyers without tax evasion on the provider’s part.

- The wages and salaries regularly paid out are particularly influential for income tax revenues in Greece. They only rose moderately, in contrast to what the saga would like. The Labour Costs Index (LCI), which measures the labour costs of the workers required to pay social security contributions in the formal sector increased on average by about 4% per annum in the 2000s (2000 – 2009). The greater part of this increase occurred in the years up to 2003. If freight rates are correctly included as part of export prices in the GDP deflator, then wages and labour costs grew much less than output prices. However, the official GDP deflator or government spending expanded by over 7% per annum. This inevitably created a gap between tax revenue and government spending. In reality, wages did not grow too strongly, but rather insufficiently. Statistically recorded real wages practically stagnated in the 2000s, even though the economy experienced an enormous boom with real GDP growth rates of well over 4% per annum. If the GDP deflator had been correctly calculated, they actually fell from 2004.

- The success of the merchant fleet had negative tax consequences. The largest and by far the fastest-growing sector of the Greek economy pays practically no tax. This is part of the explanation. The other part relates to the induced copycat effect. During the stock market boom of the 2000s, more and more Greek shipping companies were listed on stock exchanges, whether this was the NYSE, the NASDAQ or also the Athens Stock exchange. At the beginning of the decade, the stock market regulator permitted the listing of Greek deep-sea shipping companies for the first time. Shares of this sector had been previously forbidden on the grounds of investor protection due to the high cyclical volatility. There was a reverse side to the listing at home and abroad; it was now possible for informed circles to look into the shipping companies’ profit growth. And what they saw was absolutely mind blowing. Middle-sized shipowners with good timing for fleet expansion could become billionaires within a few years. They paid practically nothing in taxes, neither corporation tax nor private income tax on this income or capital tax. This boom in revenues supported a domestic construction and real estate boom in Greece and in the Islands. Heavy domestic investment activity from reeders in tourism and above all in real estate occurred whereby offshore accounts facilitated tax evasion. Corruption scandals involving large shipowners were well-known, who bribed government members and insolently pushed through their interests outside shipping also and even against decisions of the highest court. This newly created publicity allegedly contributed to a fall in taxpayer honesty. It is incomprehensible why traders, building contractors, industrialist or hoteliers should pay taxes while nouveau riche shipowners with fantastic earnings and capital gains do not. The shipowners’ publicised success undermined taxpayer honesty. And companies in other sectors could also use the regulatory and tax-related optimisation potential of lawyers and trustees.

- The mass movement into the informal sector and the credit situation of the building and property sectors led to this sector paying little or no tax. Hundreds of thousands of Albanians immigrated to Greece in the 1990s and an additional hundreds of thousands of citizens of various nationalities immigrated in the 2000s to seek work here. Something similar also happened in the other periphery countries in the 2000s. In contrast to the other periphery countries, this immigration to Greece was not encouraged by the government, but rather occurred against the resistance of the authorities and policy. Given the fact that the borders were difficult to control the return policy was ineffective. The already large informal sector offered a lot of work, especially in the booming building sector, the hospitality and hotel industries, the agricultural sector and household services. The percentage of these illegal immigrants in overall employment increased quite considerably during the growth process of the 2000s. Due to their status of not possessing residence or work permits, they were in a weak position. Their supply was very flexible, and their employment could be extended without their wages increasing. For this reason, wages and labour costs actually paid in the whole economy grew much less strongly than those officially recorded in the formal sector.

One of the myth often and often repeated again is, that wage cost grew too strongly due to extraordinary demand. The graph above highlights the relation between construction costs and real estate prices in Greece. As opposed to public perception wage cost growth was very moderate after 1995 compared to real estate prices. Wage costs and other construction input cost such as materials were no major driver of real estate prices. Real estate prices grew like in Spain or in Ireland, but wage cost was definitely not an important factor. What made real estate prices explode, was cheap credit to households and the enormous inflow from shipping revenues. The reeders diversified and invested outside merchant shipping as well. In Greece, reeders often act as real estate developers in their home island or coastal region. They have knowledge of the real estate market, access to administration and key people. The graph reveals a huge widening of construction and real estate developer margins between 1995 and 2008.

However one fundamental factor differentiated the development in Greece from that of other periphery countries. In Spain, Ireland, Portugal and, with limitations, in Italy, the whole construction and property boom was financed by bank loans to construction companies and property developers. This, on the contrary, was not the case in Greece. Elsewhere, this loan financing created fiscal transparency. In Spain, for example, the construction and property sector contributed about 30% of the total tax revenues from the corporate sector in the 2000s. In addition, the number and the proportion of workers covered by social security in the sector increased strongly, resulting in a very large increase in tax revenues from the sector. In Greece, the construction boom achieved about the same extent as in Spain. However, a similar increase in the number or proportion of insured workers cannot be established.

- The Troika rightly stressed Greece’s tax code and the (politically willed) inefficient tax administration. This issue was made the crux of a reform of at least tax administration. The Greek tax code is a conglomeration of different taxes without an overall systematic conception. Time and again in the past, ad hoc specific taxes were introduced or the corresponding tax rates or opportunities for write-offs were altered in order to plug budget gaps in the short term or, conversely, to provide an economic policy stimulus or incentive for some interest group. An example of this is the tax on interest from bank deposits, organised as a withholding tax, which cannot be offset with interest expenses. Greece’s tax administration was deliberately kept on a tight budget; everything is based on manually completed tax declarations which are not systematically saved and are not easily comparable to other documents such as bank statements. The staff are insufficient and are insufficiently trained staff to cope with the complexity of the tax legislation. Tax officials were also directly corrupt and there is no possibility of sanctions such as immediate dismissal or the confiscation of property. This situation is an Eldorado for tax lawyers, trustees and investment advisers, who can identify countless loopholes and prepare guidelines for action with respect to tax avoidance and tax evasion.

This overall constellation is the reason for an immense increase in unreported employment, tax evasion and fiscal optimisation by companies in the boom of the 2000s. Greece had the strongest economic growth out of all the euro zone countries. There was a below-average increase in the wages and income of salaried workers. In particular, the extension of low wage sectors by the immigrants working as unreported workers in the informal economy cannot be overestimated. In reality, company revenues skyrocketed. Yet fully legal (merchant shipping) and partly illegal earnings are not reflected in the companies’ tax yields, which stagnated for a full decade in absolute terms.

The introduction of tonnage tax in 1957 was appropriate. It was the correct response to the nascent flags of convenience phenomenon. The tonnage tax represented a fiscal innovation which turned Greece into the most attractive location in the world for merchant shipping. It solved the problem of low corporate taxes and private income and property taxes at the same time. It attracted the big shipowners of Greek origins or nationality located in New York, London or Monaco back to Piraeus. The tonnage tax was also appropriate as a support program for start-ups. Tax advantages are an important instrument for attracting new industries, especially in periphery or poor countries or regions. It is something else altogether to guarantee these tax benefits in perpetuity to an economic sector which has become very competitive, as occurred in 1975 with the corresponding constitutional article. And it is still something else altogether to leave everything as it was in this sector, which has become an undisputed leader in the world market, during the biggest economic crisis for decades. The tonnage tax itself is not the problem. After all merchant shipping is highly capital intense, and it is one of the most risky and violent industries with devastating periods of sector debt deflations. Many other countries have followed the Greek (Cyprus, Malta) or a similar Dutch tonnage tax system and offer generous tax advantages as well. The problem is the mix of the tax with huge unrecorded offshore accounts. Revenues and outlays for ships flying under flags of convenience are typically recorded under accounts of jurisdictions without double taxation treaty with Greece. These accounts as such represent a key obstacle for the domestic money supply process in Greece. And they may be used for unrecorded transactions not just related to shipping but also to domestic economic activities in Greece. Historically, since the late 1950s up to the great boom in the 2000s the wealthy shipowners have been key promoters of tourism, real estate and other activities like banking and refineries in Greece for diversification reasons. Those shipping offshore accounts may be used to nourish offshore accounts related to those Greek domestic activities. Domestic transactions in Greece are then just partially settled through the Greek banking system and recorded in tax declarations. A secondary offshore or even shadow monetary circuit is used to circumvent tax collection in Greece. Real estate transactions for example may be registered in Greece, but only partially paid through domestic accounts. The rest may be settled through offshore accounts in locations without double tax treaties with Greece. In the present form, the tonnage tax system offers shipowners too much optionalities, particularly with respect to registration of foreign accounts and transactions thereon.

In Greece, this has led to generalised tax evasion on the one hand and to corruption in public life, on the other. Tax evasion is not just rooted in resistance from Ottoman times to paying tribute to a hated occupying power. Furthermore, the inadequate quality of the Greek state and its services does not suffice as an explanation. The massive stocking of the state with party members who are not at all qualified for employment in the public sector is an outrage. Especially when government employees only issue licenses or provide public services in return for bribes. However, the heart of the matter lies elsewhere: A society in which the richest and most economically successful entities are constitutionally allowed to pay no taxes corrodes public taxpayer honesty especially when this is publicised and abused for other purposes. Added to this is the fact that shipowners use legal constructions and unreported offshore accounts to cancel out the withholding tax that they owe, even on their foreign accounts. And above all, not least when important exponents of this view conduct themselves in such a way in economic activities outside shipping, as if only fools paid taxes. The first-generation shipowners who immigrated to Greece from London, New York, Monaco or Switzerland in the 1960s and 1970s and the heirs and relations of these families have had a decisively influenced development in tourism, real estate and in the financial sector or in other sectors of the modern economy in Greece. This is something positive in itself. This is how a diversification of the shipping companies’ currency earnings into other export industries or into the domestic economy occurred or occurs. However, important protagonists of today’s generation also represent shining examples for the exact opposite. They treat the Greek state like a banana republic.

At first glance, insufficient tax revenue appears to be easy to remedy. The shipowners simply must be properly taxed. The first problem is that Greek merchant shipping consists of so-called cross traders. In contrast to other large fleets, they do not serve the domestic market primarily, but rather provide transport between third countries. In this respect, they are not linked to Greece and may operate from London, Monaco, Geneva or other centres. If something consequential with respect to taxes is carried out at the level of corporate taxation, then it must be coordinated at the overall European or even global level. Otherwise this would simply end with the loss of this leading economic sector in Greece. The second problem is that time for this is rather unsuitable. Shipping companies are in a deep crisis similar to that of the early 1980s. In such a situation, tax increases are inappropriate. It should be noted that there is a certain amount of scope in the long term as soon as the economic position recovers. The government halved the tonnage tax in 2002, just at the time when the largest boom of all time in merchant shipping started. This is a classical example of a wrong pro-cyclical fiscal policy. The tax rate should have been maintained at the time or rather increased than reduced. This has had consequences up to today: the tax rate for the tonnage tax is not constant and the tax per ship rises annually by about 4%. Otherwise, the tonnage tax would be constantly falling in real terms. If this tax rate is halved once, then there would be an increase of about 4% annually in the subsequent years from a very low starting level and it would therefore be lower in absolute terms. Raising the tonnage tax in the medium term to the original level or the level path does not appear to be inappropriate. Also extending the tonnage tax to ships flying foreign flags has proved to be a clever move. This arbitrage opportunity was restricted thereby. The real key task with respect to taxation is thorough registration and supervision of offshore accounts of shipowners and other economic agents. with huge fines in case of abuse for unrecorded domestic transactions.

However, the essential contribution that the shipping companies should make for the foreseeable future is not at the level of taxes, but rather to the money supply process and precisely in the present situation. History is necessary to understand this. Since 1980 Greece has developed in the wrong direction, in this context, definitely in a double or triple sense.

The circumstances in the public sector which are reminiscent of Latin America, with politically motivated recruitment and an inefficient, bureaucratic, inflated and corrupt government apparatus represent the first evident level. They go far back, but have been greatly accelerated by the decisions and course settings of Andreas Papandreou’s government in the 1980s. They should not be discussed further here. What would be required is a mix of reforms at the level of legislation, judicial, administrative and tax authorities. The Troika partially addressed some of these issues. The key default, the secondary money circuit abroad, was not tackled at all. Due to the short-term budget targets, a real administrative reform could never be implemented.

A second level concerned the economic policy response to the serious crisis in the shipping industry at the beginning of the 1980s. The Papandreou government decided on a fiscal expansion and an aggressively accommodating monetary policy with the devaluation of the drachma and a financing of the expansionary fiscal policy through the printing press. In principle, this expansionary fiscal policy was correct. In hindsight, this policy was wrong as an overall solution, because it did not take into consideration the specific currency exposure of the merchant fleet. Devaluation is useless if the revenues and the majority of the costs of the country’s largest and most important export industry are in US dollars. Furthermore, the effect of the strong increase in the labour costs of Greek semen even undermined .

Therefore, a third cause concerns merchant shipping itself and its embedding in the overall economy. From the late 1950s to 1980, the shipping industry drove the country forward. High foreign currency earnings, strong employment gains in a highly productive and well-paying sector led to multiplier and backward and forward linkage effects in line with Albert O. Hirschmann’s theory. However, there was a structural break after 1980, with long-term consequences. In particular, the number of Greek seamen fell from about 100,000 in 1980 to 35,000 in 1986 and to less than 20,000 within 20 years. Looking back, the best solution would have been to pay the seamen in USD instead of in drachmas. Yet, who can blame employees for wanting to be paid in the currency of their lf or their families and not wanting to take any currency risk? Due to the shipping companies’ severe crisis at the time, the previously tight dovetailing between the world-market oriented export sector and the overall economy slackened instead of becoming stronger as is usual in a growth process. Greek shipowners registered their ships under flags of convenience so that they could avoid the trades union – established wages of Greek seamen and sign up cheap workers from the Philippines and India as seamen. Furthermore, they no longer had to insure them with the seamen’s pension fund. The number of Greek seamen in the shipping industry fell rapidly. The shipyards lost their significance as suppliers for new construction and repairs, given the shipping companies’ severe crisis.

The adoption of the euro created an improved dovetailing with the domestic economy again. Greek banks could make increased loans for the financing of the merchant fleet. Insurers and other specialised service providers such as development and consulting firms, suppliers and maintenance companies and shipbrokers grouped themselves in a cluster around Piraeus for this purpose. However, the fundamental problem remained the shipping companies’ extraordinary currency exposure. Up till 2001, the merchant shipping industry was dollar-denominated in a small open economy with its own currency and a banking system which in contrast to New York was underdeveloped, highly regulated and was also still characterised by decades-long rigid capital controls. An unbridgeable area of conflict was created as a result. Since the introduction of the euro, merchant shipping is still dollar – denominated, but in a small open economy in a currency union with the second most important currency in the world and also with a banking system with all technical characteristics and solutions as offered by New York or London. This opens up completely new possibilities.

With respect to labour costs, nowadays, payments in USD could be combined with a compensation mechanism (optionality) in the event of adverse currency developments. Given the development of options techniques in the currency markets, such a solution is easy to structure. This was not possible in the late 70s and early 80s, and definitely not in relation to a marginal currency like the drachma. Still, today, the merchant shipping industry’s wage problem is a priority. While inflation in Greece is no longer in double digits year after year, Greek seafarer wages are too high to allow large scale recruitments. What should be lowered, are initial salaries for seamen, in order to allow higher recruitments of Greek seamen and higher staff later on.

Greece’s much more fundamental core problem is that the recycling of foreign currencies from shipping exports does not work properly. They are mainly held in USD accounts abroad, mostly in the name of offshore legal entities without double taxation agreements with Greece. Ships under flags of convenience often or even mostly are registered under companies of respective legislation. This has negative consequences for the banking sector. Most European countries are deeply integrated into the world market. Their companies send about 50% to 70% of exports to Europe and are mainly paid in euro, sometimes even for deliveries outside Europe. Most of their costs are also incurred in euro. These companies can hold their accounts in the domestic banking system without any problems and have all services available. This constitutes a reasonable requirement for a workable domestic banking system. There is no fundamental disruption of asset and liability management in the banking system.

In contrast, in Greece, the earnings of the country’s largest export industry by far and its most important economic sector lie in offshore accounts abroad which are denominated in dollars. Such capital export also partly occurs in the hotel industry, especially among the four – star and five –star hotels, mostly in euro accounts. This is disadvantageous to the domestic banking system. A credit expansion in the system must almost inevitably be financed with a short-term capital import. This makes the country highly dependent on capital inflows from abroad. From the 1980s until the introduction of the euro, the remittances of Greeks who had emigrated and were living abroad and the payments from EU funds were necessary to cover the current account deficits from commercial payments. Emigrant remittances dried in the 2000s and the credit expansion accelerated, with the result that after the introduction of the euro, mainly short-term capital imports in the euro interbank market to had to be brought in to plug gaps. Currently, after several years of severe banking crises, the whole Greek banking system is financed by the ECB to a considerable extent, which is unsustainable over the medium and long term. Technically it goes like this: the banks hold liabilities with the Greek central bank. The latter, on its own part, then builds up obligations vis-a-vis other central banks in the target mechanism.